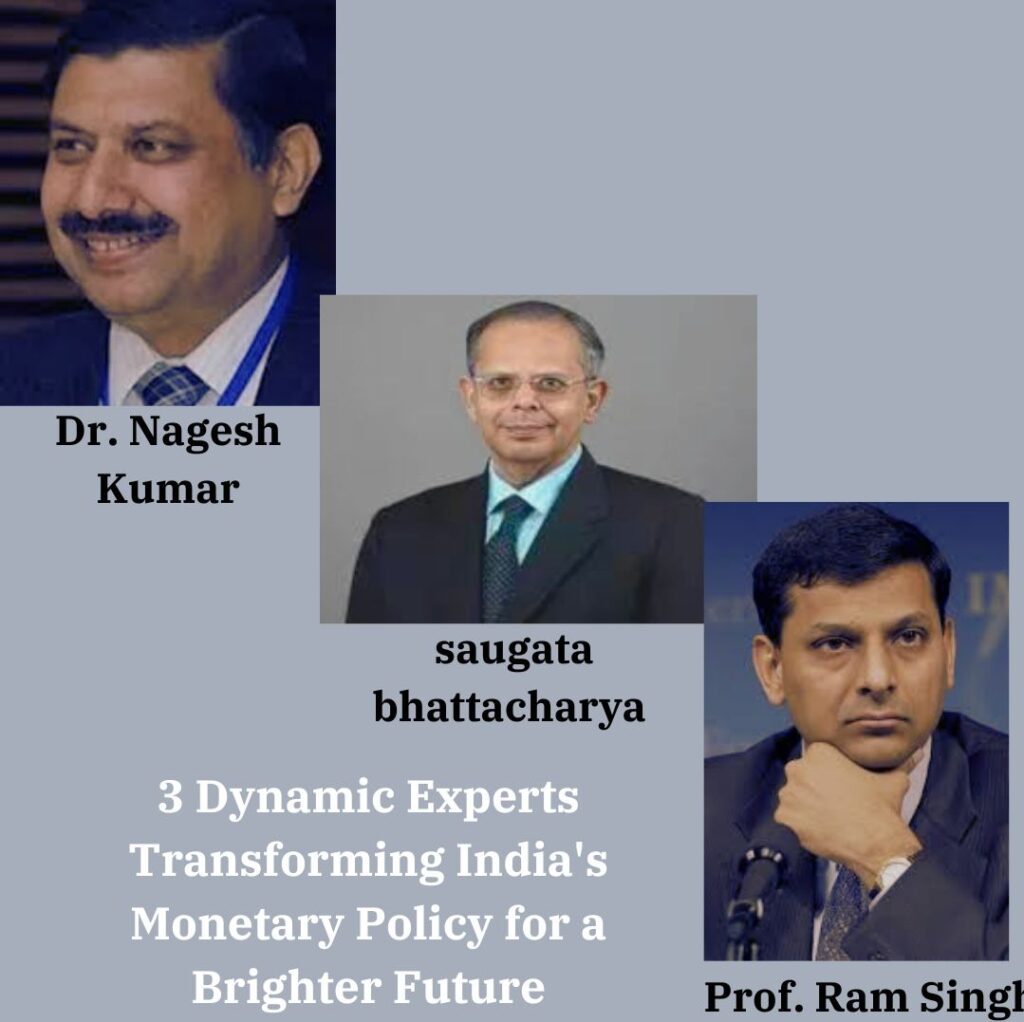

3 Dynamic Experts Transforming India’s Monetary Policy for a Brighter Future

Government Reconstitutes RBI’s Monetary Policy Committee: Appoints Three New Members

The Government of India has reconstituted the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) and appointed three new members: Prof. Ram Singh, Saugata Bhattacharya, and Dr. Nagesh Kumar. This reconstitution comes just before an important meeting scheduled for October 9, 2024, where the MPC will discuss and announce its decisions on policy rates.

What is the Monetary Policy Committee (MPC)?

The Monetary Policy Committee (MPC) is a six-member body tasked with determining the key policy rates of the RBI, primarily focusing on maintaining inflation within the government-mandated target. It was first constituted on September 29, 2016, following amendments to the Reserve Bank of India Act 1934 under the Finance Act of 2016.

According to Section 45ZA of the RBI Act, the government of India sets an inflation target, usually in terms of the Consumer Price Index (CPI), which the MPC must strive to meet. The government revises this target every five years, and the MPC’s role is to ensure that the rates are aligned to help achieve these goals.

The Search and Selection Committee

Under Section ZC of the RBI Act 1934, a Search and Selection Committee is constituted to recommend suitable candidates to the MPC. This committee is composed of:

- Cabinet Secretary, who chairs the committee—currently T. V. Somanathan.

- Governor of the RBI, or his representative, usually a Deputy Governor.

- Secretary, Department of Economic Affairs—currently Ajay Seth.

- Three nominated experts from economics, finance, or monetary policy.

The Search and Selection Committee plays a vital role in appointing external members of the MPC, ensuring that they possess the requisite expertise in the fields of economics, finance, or monetary policy.

Structure of the MPC

The Monetary Policy Committee is composed of six individuals:

- Three members from the RBI:

- RBI Governor: Dr. Shaktikanta Das (also the chairman of the MPC)

- RBI Deputy Governor in charge of Monetary Policy: Dr. Michael Debabrata Patra

- Executive Director of Monetary Policy at RBI: Rajiv Ranjan

- Three external members have been appointed by the Government of India.

-

- Prof. Ram Singh, who serves as the Director of the Delhi School of Economics.

- Saugata Bhattacharya, Senior Fellow at the Centre for Policy Research (CPR) and former Chief Economist at Axis Bank

- Dr. Nagesh Kumar serves as the Director of the Institute for Studies in Industrial Development (ISID).

Who Are the New Members?

Let’s take a closer look at the newly appointed external members of the MPC.

Prof. Ram Singh

Prof. Ram Singh is a well-respected economist and currently serves as the Director of the Delhi School of Economics. He holds a PhD from Jawaharlal Nehru University (JNU) and a post-doctorate from Harvard University. Singh has also served as a professor at several esteemed institutions, including Bucerius Law School and Heidelberg University.

Saugata Bhattacharya

Saugata Bhattacharya is an experienced economist with more than 30 years of experience in economic and financial market analysis. He is currently a Senior Fellow at the Centre for Policy Research. Before joining CPR, Bhattacharya served as the Chief Economist and Executive Vice President at Axis Bank, where he worked on infrastructure and project finance, as well as consumer behaviour analytics.

Dr. Nagesh Kumar

Dr. Nagesh Kumar holds the position of Director and Chief Executive at the Institute for Studies in Industrial Development (ISID). Prior to this, he was the Director at the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP). Kumar has extensive experience working in policy think tanks, having served as the Director-General of the Research and Information System for Developing Countries (RIS) between 2002 and 2009, which operates under India’s Ministry of External Affairs.

Tenure and Functions of the MPC Members

The tenure of the external members of the MPC is four years. Importantly, they are not eligible for reappointment after their tenure ends. They can, however, be removed by the government under certain conditions, such as misconduct, or if they wish to resign on their own.

The primary responsibility of the MPC is to determine the policy rates that are crucial for controlling inflation. Under Section 45ZA of the RBI Act, the MPC sets rates to meet inflation targets, and these decisions are taken through voting. If there’s a tie in votes, the RBI Governor, as the chairman, holds the casting vote.

Upcoming MPC Meeting and Expectations

The newly reconstituted MPC will begin its first meeting on Monday, October 9, 2024, to discuss key monetary policy decisions. Despite the recent change in the composition of external members, analysts widely anticipate that the MPC will maintain the interest rate at its current level. The last revision of the interest rate took place in February 2023 when the rate was increased to 6.5%.

This is expected to be the 10th consecutive time that the MPC has kept the interest rate unchanged. The unchanged stance on policy rates is likely due to the existing economic conditions, where inflation is being carefully monitored against the backdrop of global financial trends.

External Members Replace Previous Appointees

The recent appointments coincide with the conclusion of the four-year terms of the outgoing external members, Ashima Goyal, Jayanth Varma, and Shashanka Bhide. These individuals were pivotal in the committee’s recent decisions and contributed significantly during their tenure, especially in navigating the Indian economy through the pandemic.

It is noteworthy that the extended tenure of Governor Shaktikanta Das and Deputy Governor Michael Patra is set to expire soon—December 2024 and January 2025, respectively. This means more changes in the RBI’s leadership are expected in the near future, which may further impact monetary policy decisions.

A Crucial Role in Shaping India’s Economic Landscape

The Monetary Policy Committee plays an essential role in shaping India’s monetary policy and ensuring financial stability. As the newly appointed members take charge, they will face the critical task of addressing inflation while fostering economic growth. Their first meeting, slated for October 9, 2024, will be closely watched, especially as India continues to navigate its post-pandemic recovery amidst global financial uncertainties.

FAQs:

Question: Who are the newly appointed members of the Monetary Policy Committee of the RBI?

Answer: The new members are Prof. Ram Singh, Saugata Bhattacharya, and Dr. Nagesh Kumar.

Question: What is the total number of members in the Monetary Policy Committee of the RBI?

Answer: The Monetary Policy Committee consists of six members.

Question: When was the first Monetary Policy Committee of the RBI notified?

Answer: The first Monetary Policy Committee was notified on September 29, 2016.

Question: What is the term length for the members appointed by the Government of India to the Monetary Policy Committee?

Answer: The term length is four years, and they are not eligible for reappointment.

Question: What role does the Monetary Policy Committee play in the RBI?

Answer: The committee determines the policy rates of the RBI to achieve the inflation target set by the Government of India.

Question: Who heads the Monetary Policy Committee?

Answer: The Governor of the RBI, currently Dr. Saktikanta Das, heads the committee.

Question: Which three previous external members’ terms have expired?

Answer: The expired terms belong to Ashima Goyal, Jayanth Varma, and Shashanka Bhide.

Question: What qualifications does Prof. Ram Singh have?

Answer: Prof. Ram Singh is the Director at the Delhi School of Economics and has completed his PhD from Jawaharlal Nehru University and a Post-Doctorate from Harvard University.

Question: What is the main objective of the Monetary Policy Committee?

Answer: The main objective is to maintain price stability while keeping in mind the objective of growth.

Question: When is the next meeting of the reconstituted Monetary Policy Committee scheduled?

Answer: The maiden meeting is scheduled for October 9, where the outcomes will be announced by the RBI Governor.

OTHER LINKS:

Cruise Bharat Mission: A Voyage to Transform India’s Cruise Tourism